YouWin Consulting offer one-stop solutions for your business in China: from helping you to establish a strong presence and streamline your business & accounting processes, to helping you to hire foreign experts & provide you with visa services for your employees.

Navigating though complex business system in China

Visa Services—

Visa Services—

Visa Services—

Visa Services—

Work permit is also called work permit card.

Process:

- Documents Preparation; find document list bellow

- Online Document Submission & Application (2 working days)

- Feedback from Chinese Labor Bureau (approx 5 working days)

- Approval Process (approx 7–10 days)

- Collection of the Work Permit Card

Did you know?

- Work permit is a proof of your employee–employer relationship and required to obtain to work legally in China.

Work Permit based on the China category sysytem:

- Category A, which main for the person whose annual salary above 600,000 RMB

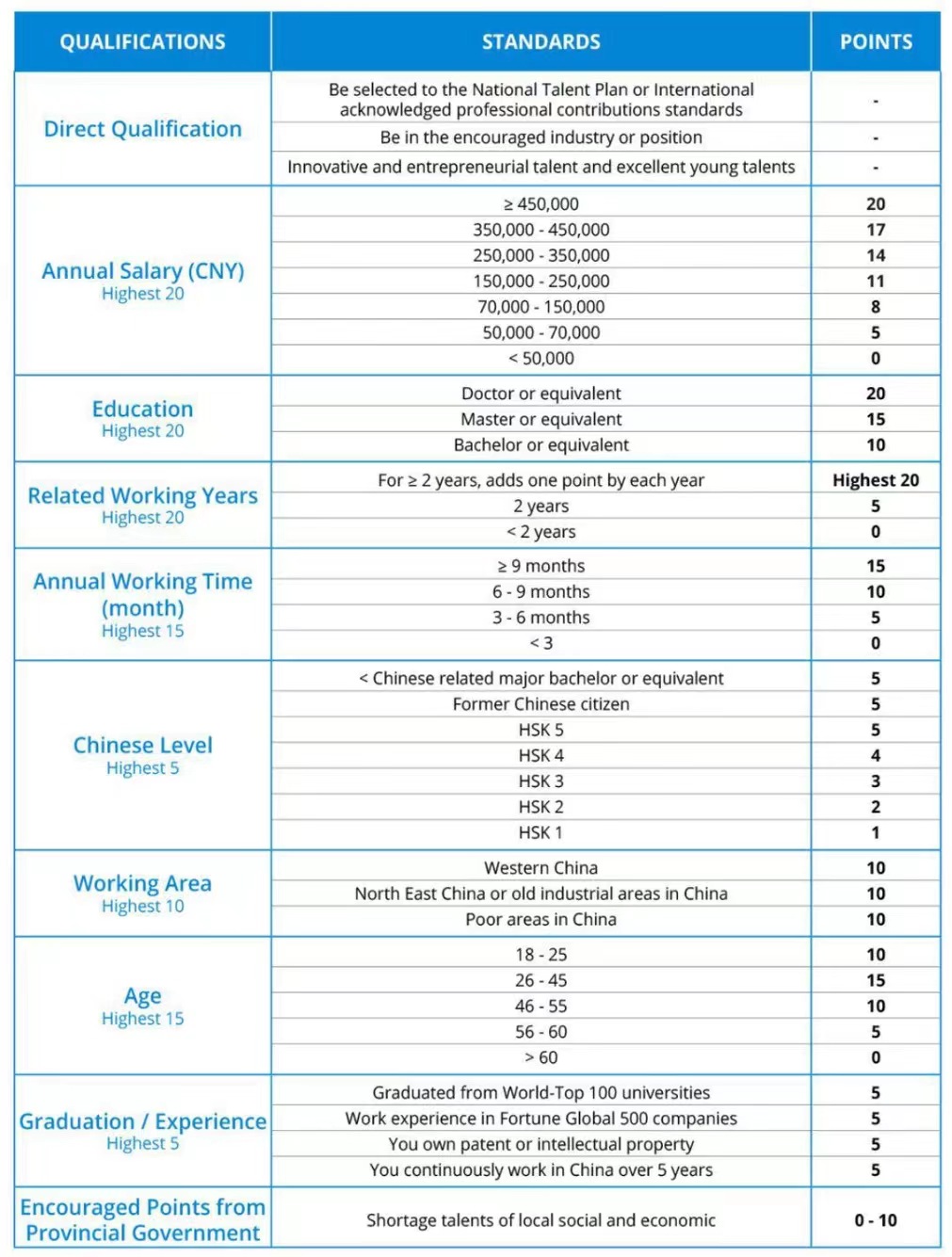

- Category B, which main for who has bachelor degree(or above) and 2 years related working experience. If don’t have, don’t worry, you can use the 60 points system (click to see the attached picture detail)

- Category C, which main for the fresh graduates.

The residence permit in China looks just like a visa and is pasted into your passport very similarly.

Advantages of residence permit:

- You can enter and exit China without any limits

- The stay period is usually for one year

- You can work and stay legally in China

Process:

- Physical Examination (we will schedule appointment for you) (approx. 4 working days)

- Residence Address Registration Online (1 working day)

- Application Submission in Entry-Exit Immigration Bureau (1 working day)

- Processing & Immigration Bureau Feedback (approx. 7 working days)

- Passport Collection

We provide comprehensive service to assist you with the various visa categories extension:

- Q1&Q2 visa

Relatives of Chinese citizens residing in China and relatives of foreigners with Chinese permanent residence qualifications who visit their relatives in China. - S1&S2 visa

Spouses, parents, children under the age of 18, parents of spouses of foreigners who have stayed in China for work, study and other reasons to visit their families for a long time, and persons who need to stay in China for other private affairs. - Business visa

For business investigation, project guidance and sports events in China. - Tourist visa

Currently service is susspended.

Process vary depending on the type of the visa extension required, but generally consists of:

- Collection of Documents (Q1, Q2, S1, S2, Family Certificate Verified by the Embassy)

- Submission in Exit/Entry Immigration Bureau (processing time approx. 7 working days).

- Passport Collection

YouWin will provide you with the necessary documents list & assist with collection and certification process.

Requirements for Family Residence Permit:

- If your husband or wife work in China, you can apply family visa

- If your directly-related members family are Chinese, you can apply family visa

- If your mother/father/children wants to come live with you, while you have work visa in China, they can apply for family visa.

Please prepare the Relationship Certificate and Certification.

We will help you apply within 7 working days.

Requirements for Permanent Residence Card:

- If you work in China more than 4 years continuously

- If you are married with Chinese Citizen for more than 4 years

Contact us to check if you meet the conditions for applying for permanent residence.

Chinese Visa Services

Frequently asked questions

How to start New Chinese Visa Application?

- Prepare documents required for new application

- We apply the Work Permit Notice for you

- Apply Z visa in Chinese embassy from abroad

- Come in and finish the quarantine (7+3days)

- We apply the Work Permit card for you

- We apply the Work Residence Permit for you

If you already in China with other type visa, congratulations, we just proceed the step 1 、 step 5 and step 6.

Documents required:

- 申请人护照首页;

Passport photo page scanning; - 最高学历证书原件(学士学位及以上),以及公证认证原件。

The highest diploma (Bachelor or above) , the original must be sent to Chinese embassy for certification. - 公司开具可以证明申请人自大学毕业之后算起满两年以上的相关工作经验证明信原件。

The working experience letter issued by company which can prove the applicant has completed more than two years related work experience after graduation. - 申请人的境外无犯罪记录证明原件,以及公证认证原件。

No criminal record certificate and certificated by Chinese embassy. - 白底彩照电子档

Electronic pictures with background - 劳动合同或派遣函

Labor contract or dispatch letter - 个人简历一份

Electronic Resume

Notice:

当申请人入境后 24 小时之内及时去派出所或酒店办理住宿登记。并去医院体检。

After the applicant entered China, need to go to the police station or hotel for registration within 24 hours. And do the physic examination (we’ll make appointment for you).

Time cost:

工作许可通知 15 个工作日;工作许可证 15 个工作日;工作签证 7 个工作日;

The work permit notice takes 10–15 working days

Work permit card takes 10–15 working days

Work residence permit takes 7 working days

How to renew Chinese Visa in the same company?

- Prepare documents required for renewal (See the attached documents list)

- We help renew Work Permit card for you

- We help renew Work Residence Permit for you

Documents required:

- 申请人护照首页/居留许可页/最新入境章页扫描;

Passport photo/work visa page/last entry stamp page scanning; - 工作许可证正反面扫描件;

Both sides of work permit scanning; - 劳动合同或派遣函

Labor contract or dispatch letter - 临时住宿登记单

Temporary residence registration paper;

Time cost:

工作许可延期(5–10 个工作日);工作签证延期(7 个工作日)

Work permit renewal(5–10 working days)

Work residence permit renew(7 working days)

What is the procedure to legally change your job in China?

- Prepare documents required for Changing

- We help renew Work Permit card for you

- We help renew Work Residence Permit for you

Documents required:

- 申请人护照首页/居留许可页/最新入境章页扫描

Passport photo/work visa page/last entry stamp page scanning - 最高学历证书原件(学士学位及以上),以及公证认证原件

The highest diploma (Bachelor or above) , the original must be sent to Chinese embassy for certification - 公司开具可以证明申请人自大学毕业之后算起满两年以上的相关工作经验证明信原件

The working experience letter issued by company which can prove the applicant has completed more than two years related work experience after graduation - 与新单位的劳动合同或派遣函

Labor contract or dispatch letter with the new employment company - 上家单位离职证明原件

Original employment separation letter from the previous company - 上家注销单原件

Original work permit cancellation paper from the previous company - 住宿登记单

Temporary residence registration paper

Time cost:

新单位工作许可证 15 个工作日;新单位工作签证 7 个工作日;

Work permit takes 10–15 working days

Residence permit takes 7 working days

What are the steps to do when you finish or cancell your job in China?

- Prepare documents required for Cancellation (See the attached documents list

- We help cancel Work Permit card for you

- We help cancel Work Residence Permit for you

Documents required:

- 申请人护照

Passport - 申请人工作许可证

Work permit card - 单位离职证明原件

Original employment separation letter - 住宿登记单

Temporary residence registration paper

Notice:

申请人离职 10 天内要及时办理注销相关手续。

Applicant should start the cancellation process within 10 days after finish the job.

Time cost:

工作许可注销 3–5 个工作日;居留许可注销 5 个工作日;

The work permit cancellation takes 3–5 working days

Work residence permit cancellation takes 5 working days

What to do when my Chinese Visa Expired or Overstayed?

- Check your type of visa & oversta time to calculate how many days you have overstayed

- If your overstay is within 10 days — the Exit Entry Bureau of China Immigration will issue a warning only

- If you overstay above 10 days — please be prepared to pay a fine of 500 RMB per day + warning from the Bureau.

- Bring your passport & residence registration document to Immigration Bureau and explain the reason of overstay (examples: quarantine, no flight, sickness — and prepare a proof of that reason)

- Immigration Bureau of Exit/Entry in China will issue 1 month Stay Visa Type within 7 working days.

- Collect your passport.

Company Services—

Company Services—

Company Services—

Company Services—

How can we help with Opening Company and when?

- If you have a good business plan, have resources and contacts for trading

- If you want to do your own business

- If your mother company needs to develop the Chinese market

- If you are a freelancer but can not get the payment from company to company

If you meet any of the conditions mentioned, it’s a good opportunity for your to start your own company in China!

We can help the whole process for you no matter you are in China or abroad now and we can provide the company registration address for you. Then you don’t need rent office in advance.

There are few major company types to choose from:

Wholly Own Foreign Enterprise, Sino-Foreign Joint Venture, Representative office, etc

Generally, the process is custom tailored for your needs and takes approximately 2–3 weeks. The main steps of the Chinese Company Registrations consists of:

- Choosing Company Name

Please provide 3–5 English names, we can help to translate and choose appropriate Chinese name/character equivalent. There final decision of the registered name is up to the Business Registration Office, so the choices provided should be well thought through. - Define Business Scope

Business scope depends on the operating industry & services provided by the company, we can provide you with the sample list for relevant industries examples of scope: Trading / Business Consulting / Cultural and Creative Services / Design Services / Health Consulting / Sports event etc. You should include all current and future business activities, since that information is publicly accessible in the Company Registration System. Please contact us for more details. - Choose Registered Capital

Registered capital amount will be shown on your Business License and will be a proof of the ability for financial responsibility as a Company — accepted currencies are: RMB/USD/EUR, etc. Registered Capital is a subscription based system, which does not require to have an immediate investment, but should be collected over period of time, 30 years or longer.

After successful verification of the Company Information & Collection of the data, the next step is to apply for a Chinese Business License & Official Stamps.

To successfully apply for a business license, you need to pass the name + information collection steps.

The business should have as well the location — in this case YouWin can provide you with the list of the office partners tailored to your needs: from shared desk space office — which is perfect for a startup, consulting or art-related companies, to dedicated office space. Feel free to contact us if you need any suggestions.

After the documents are collected — we will help you to go thought the verification process. The general timing of the whole process which result in obtaining business license is as follows:

- Step 1: Company Name Approval (approx. 3 working days)

- Step 2: Company Registration Address (approx. 2 working days)

*registration address can be different that the company office address, it is bound to the district tax office - Step 3: Prepare the necessary list of the documents for signing (approx. 1 working day)

*YouWin will provide the document list & examples based on your company type - Step 4: Documents submission including Passport of the Legal Owner of the Company (approx. 1 working day)

- Step 5: Business License Collection & Issuing of the Official Company Stamps (approx. 5 working days)

*to legalise all the contracts and company legal documents, Chinese Companies have official “red” stamps that are required not only for labour contracts, but also the clients contracts, accoutning operations and other government required documents

Opening a Company Official Bank Account is a neccesary step after optaining Business License to ensure the proper operation of the company. There are several types of the accounts that can be registered based on the Company Operational needs:

- Basic Chinese Company Bank Account

—this account type is necessary to legally operate in China. Company can have only 1 official bank account. This account is connected to the nation-wide tax system, and the deduction of the taxes and government fees are done automatically via banking system. This Bank Account Operates in CNY (RMB) and any foreign currency operations are exchanged automatically. - Foreign Currency Chinese Company Bank Account

—additional bank account that let you to operate in foreign currency without a need of the instant exchange. If majority of your operations are done in foreign currency, this type of Chinese Company Bank Account let you to operate, store and receive the foreign payments without currency exchange cost. - Capital Account

When you plan to invest or transfer the capital for running of the company (often at the begining of the setting up business), you should open the Chinese Company Capital Account. The invested capital amount will be kept separately in this account, and when there is a need for the insert of the investment capital, Company can transfer the required amount to the basic account.

The Process:

- Prepare required list of documents (we will provide you a guide & document list).

- Schedule appointment with the bank (we will setup the date and time for the registration process)

- Pass the office verification process (usually Bank Representative will visit registered office location to verify the operation of the Company)

- Submit the Application in Bank

Time Duration: approx. 5 working days for each account.

Company Registration Services

Frequently asked questions

What are first steps when you want to open company in China?

- Company (In English or in Chinese)

- Capital amount

(The registered capital doesn’t need to be actually paid in, and there is no Minimum Limit) - Business scope

- Information about shareholder / Legal Representative / Supervisor: Passport Photo Page / Phone / E‑mail / Contact Address

What are the steps to obtain Business License in China — required documents?

- We help for company name approval (About 3 working days)

- We help apply the address registration in downtown (About 2 working days)

- We help prepare the related documents for signing

- We help collect the business and official stamps.

What are the next steps after company registration in China and business license have been completed?

- Open company basic bank account & USD account (if need)

- Tax registration to choose General tax payer or Small scale tax payer

- Apply invoice key and electronic invoice

- Tax declaration and accounting regular monthly

- Tax settlement and commercial inspection yearly

How to choose between General VAT taxpayer or Small Scale VAT Taxpayer in China? What are differences?

| No. | Item | VAT Small–Scale Taxpayers 小规模纳税人 |

VAT General Taxpayer 一般纳税人 |

|---|---|---|---|

| 1 | Application Criteria 认定条 件 |

1) Company shall be ratified as VAT small-scale taxpayer when registration with no need for separate application; 无需申请,公司注册时自动被认定为小规模纳税人;2) The company’s annual taxable sales shall not exceed RMB5 million. 年应征增值税销售额不得超过人民币 500 万元。 |

1) The company shall apply for the qualification of VAT general taxpayer when its annual taxable sales reach or exceed RMB 5 million, if not apply, it shall be compulsorily ratified as VAT general taxpayer; 年应征增值税销售额超过人民币 500 万元,应当申请认定成为一 般纳税人,否则会被强制认定成为一般纳税人;2) Newly registered company or company with annual taxable sales not exceeding RMB5 million can apply for the qualification of VAT general taxpayer if it has fixed operation place and can provide legal and valid vouchers and accurate tax filing data. 有固定经营场所、且根据合法、有效凭证核算,能够提供准确税务资料,年应税销售额未超过小规模纳税人标准以及新开业的纳 税人,可以申请一般纳税人资格认定。 |

| 2 | Tax and Levy Rate 税率与征收 率 |

The applicable levy rate is 3%. 征收率为 3% |

The applicable tax rate is divided into four levels,13%, 9%, 6% and 0% respectively. 税率为 13%,9%,6% 及 0% 四档。 |

| 3 | Tax Filing Method 纳税申报 方式 |

VAT and its surcharges shall be declared on quarterly basis. 增值税及其附加费按季度申报。 |

VAT and its surcharges shall be declared on monthly basis. 增值税及其附加费按月申报。 |

| 4 | Tax Calculation 计税方法 |

Taxable Sales/(1‑Levy Rate) × Levy Rate. 含税销售额/(1+征收率)× 征收率。 |

Output VAT – Input VAT. 抵扣制:销项税额-进项税额。 |

| 5 | Input VAT 增值税进项税额 |

Not deductible. The input VAT obtained for purchasing goods, assets and taxable service is not deductible even if VAT special invoice could be obtained. 不能抵扣。购进货物、资产或应税劳务或服务时,即使取得了增 值税专用发票也不能进行抵扣。 |

Deductible. The input VAT as shown on the VAT special invoice for purchasing goods, assets and taxable service and the withholding VAT incurred for remitting payments to foreign companies is deductible. 可以抵扣。购进货物、资产或应税劳务或服务而取得了增值税专用 发票所列的增值税可以申请抵扣;对外付汇时代扣代缴的增值税也 可以申请抵扣 。 |

| 6 | Input VAT Accounting Treatment 增值进项税额的账务处理 |

The price and relevant VAT shall be posted into the accounts of assets, costs or expenses in full amount. 全额计入资产或成本费用。 |

Adopt “price and tax separated” policy. The price shall be posted into the accounts of assets, costs or expenses, while, the VAT shall be posted into the account of tax payable-VAT payable-input VAT, so as to offset output VAT. 价税分离:价款部份计入成本费用或资产等,税款部份计入应交税金-应交增值税-进项税额,抵减销项税额。 |

| 7 | Issuance of VAT Special Invoice 增值税专用发票 |

1) VAT small-scale taxpayer with monthly sales not exceeding RMB30,000 or quarterly sales not exceeding RMB90,000 whose business scope covers accommodation, consultancy, construction, manufacturing, software, information transmission, information technology can issued VAT special invoice by itself; 企业的经营范围内含有住宿业、咨询服务或建筑业、工业、软 件业、信息传输业、信息技术服务业,且月销售额超过 10 万或 者季度销售额超过人民币 30 万,可以自行开具增值税专用发票;2) Other companies shall need to apply with tax bureau to issue VAT special invoice; 其他企业要开具增值税专用发票,只能由税务局代开;3) The VAT rate shown on the VAT special invoice shall be 3% for the invoice either issued by company itself or by tax bureau. 无论是自行开具还是税局代开增值税专用发票,发票上的增值 税税率均为 \3% 。 |

VAT special invoice can be issued for goods selling or taxable service rendering and the rates shown on the invoice can be 13%, 9% or 6%.

销售货物或提供应税劳务以及服务可以开具增值税专用发票,增值税专用发票的税率为 13%,9% 或 6% 。 |

| 8 | Export Tax Rebate 出口退税 |

VAT shall be exempted for export business and no rebate can be applied. 出口免征增值税,不能申请退税。 |

The applicable VAT rate is 0% for export business. Refund can be applied for the input VAT generated for purchasing of goods and taxable service and the rebate rate or amount of tax refund shall be subject to the category of the exported goods or service. 出口增值税税率为 0%,购进货物或服务支付的增值税进项税额可以申请退回,退税率或退税额根据实际出口货物类别或服务而定。 |

| 9 | VAT Preferential Tax Policy 增值 税优惠 |

1) As at 31 December 2020, small and micro enterprises with monthly sales not exceeding RMB100,000 can enjoy VAT exemption; 至 2020 年 12 月 31 日,月销售额不超过人民币 10 万元,小微 企业免征增值税;2) As at 31 December 2020, enterprises engaging in goods or intangible assets selling, repairing and other taxable service rendering with monthly sales not exceeding RMB100,000 (quarterly sales not exceeding RMB300,000) can enjoy the VAT exemption. 至 2020 年 12 月 31 日,销售货物或者加工、修理修配劳务月 销售额不超过人民币 3 万元(按季纳税人民币 9 万元),销售 服务、无形资产月销售额不超过 3 万元(按季纳税人民币 9 万 元)的,可分别享受小微企业暂免征收增值税优惠政策。 |

NIL 无 |

| 10 | Urban Construction Tax Preferential Policy 城建税优惠 |

Urban construction tax shall be exempted together with the exemption of VAT and the exemption criteria are the same as those for VAT. 免征增值税时,城建税将相应获得免征(标准同上)。 |

NIL 无 |

| 11 | Surcharges Tax Preferential Policy 附加费优 惠 |

Small and micro enterprises with monthly sales or business income no more than RMB100, 000 (quarterly sales or business income not exceeding RMB300,000 for quarterly filing taxpayer) shall be exempted from educational surcharge, local educational surcharge and water conservancy and construction fund. | 月销售额或营业额不超过人民币 10 万元(按季度纳税的季度销售额或营业额不超过人民币 30 万元)的小微企业,免征教育费附加、地 方教育附加、水利建设基金。 |

| 12 | Corporate Income TAX Preferential Policy 企业所得税优惠 |

In line with the small profit enterprises can enjoy preferential policies for corporate taxes.There are three taxes rate depends on the total amount of annual profits. | Annual profit<=1000,000 CNY, taxes rate: 5% 1000,000<=Annual profit<300,000CNY, taxes rate: 10% Annual profit>300,000CNY, taxes rate: 25% |

| 13 | Applicable Enterprises 适用企业 |

Applicable to those companies which cannot obtain VAT special invoice and will not issue VAT special invoice. 未能取得增值税进项专用发票且无需开具增值税专用发票。 | Applicable to those companies which 适用于下述企业: 1) need to issue VAT special invoice; or 需要开具增值税专用发票;或 2) have large amount of input VAT to offset output VAT; or 值税进项税额比较大可以获得抵扣税制之优惠;或 3) need to apply for VAT rebate for export business. 出口业务需要申请增值税退税。 |

1. Annual taxable sales refer to the accumulated VAT taxable sales for no more than 12 consecutive months, including the tax exempted sales.

年应税销售额,是指纳税人在连续不超过 12 个月的经营期内累计应征增值税销售额,包括免税销售额。

2. Recognition Conditions for Small and Micro Scale Enterprises

小微企业的认定条件:

(A)Enterprises with annual taxable income of no more than RMB1 million;

年应纳税所得额低于人民币 100 万元(含 100 万元);且

(B)For manufacturing enterprises, the employees shall not exceed 100 heads and the total assets limit to RMB30 million;

工业企业,从业人数不超过 100 人,资产总额不超过人民币 3,000 万元;或

(C)For other enterprises, the employees shall not exceed 80 heads and the total assets limit to RMB10 million.

其他企业,从业人数不超过 80 人,资产总额不超过人民币 1,000 万元。

Accounting Services—

Accounting Services—

Accounting Services—

Accounting Services—

- Serivce Overview

- Bookkeeping & TAX

- Invoicing

- Online Banking

- Human Resources

- Annual Inspection

- Export Tax Refund

Why we differ from other Service Providers and What are benefits of Choosing YouWin Consulting as your Chinese Company Accounting & Operation Service Provider?

Since first opened, YouWin Consulting helped businesses to establish and grow in China. To have a proper setup of the services & manage them well, is a challenge, and many businesses operate in decentralised way. This is why we differ from the competition: we aim to centralise all the operations within our office, by selectively building a team of professionals specialised in accounting, business, human resources, etc. That allows us to control the process from start to finish in efficient way, and limits the processing time for the clients. That approach led us to have a loyal clients base that stay with us over the years and trust us with their company operations.

We developed the dedicated service price point based on your company size. We believe in the young creatives and business entrepreneurs — so we adjust the pricing based on your needs.

- Regular Process Reminders — your dedicated account manager will contact you regularly with specified instruction of the time and required processes to follow to maintain proper company accounting

- High Efficiency — in 99% of cases, the task you required to finalise (transfer, invoice issue, document print, bank operation) are done within the same working day

- No Outsourcing — all our processes are handled by dedicated department in the company: from visa extension, to company verification & accounting processes, we handle all the tasks within the company structure, reducing time and mistakes that can occur when working with outsourcing

- Latest Policy Updates — we keep up to date with latest policy and requirements updates and share with the clients, including the suggestions for optimising and improving efficiency of your operations

- One–Stop–Service — since the processes are handled within one organisational structure, there is big improvement of communication and operation time

Each monthChinese Companies are required to submit:

VAT Tax, Corporate Tax, Personal Income Tax.

Our bookkeeping service includes:

- Preparation & maintenance of the accounting books

- Invoice collection & maintenance

- Cost collection & expense calculation

- Monthly reminders for the documents submission

- Financial report preparation (Chinese & English version available)

- Bank monthly statement collection & verification

*Chinese company need to submit the official bank statement report together with the tax, we can help you to collect all the information needed, so there is no need for the representative to go to the Bank Branch in person

Service Benefits:

- Each client account will have dedicated accountant for direct contact & process management

- High efficiency service — the processes and reminders are delivered in timely manner, usually within the same day

- Staying up-to-date with the latest policy updates for Companies – any changes in the taxrates, payments or company operationpolicies are communicated bilingually – with explanation if needed

- Custom tax & advisory — we provide you with custom tax advisory and cost management to improve the overall revenue and cost planning for your long-term operations

Understanding Chinese Invoicing System can be challenging at first: there are 2 types of the Chinese Invoices, General VAT Invoice and Special VAT Invoice.

General Chinese VAT Invoice

General VAT Invoice, also called Standard Fapiao (增值税普通发票) is an invoice usually issued by small–scale taxpayers. This invoice have a reduced tax rate, and it resembles receipt in foreign countries. Its format is the same as the Special VAT Invoice, but the tax is calculated differently. With the General Invoice, the VAT tax is not used to claim the Input VAT credit to offset the VAT at the end of the month. Those invoices are popular among small businesses and enterprises, and are issued if the company does not exceed 5 mln RMB yearly. In case of the General Chinese VAT Invoice, the tax amount is paid at the end of the tax period, usually monthly or quarterly. General VAT Invoice is especially useful for startup and small business, since it have reduced tax rate. It is a perfect solution for small business, that can have lower tax burden in the first years or operation.

Special Chinese VAT Invoice

Special Chinese VAT Invoice, also called Special VAT fapiao (增值税专用发票), is invoice issued by general taxpayers. This type of invoice is issued by the Chinese TAX Administration Bureau (which is a dedicated bureau based on your business registered location). With Special VAT Invoice, the VAT the general taxpayer can claim the Input VAT and use it to offset the VAT at the end of each month. In case of the paper invoices — you have to go directly to the Chinese TAX Bureau to claim the invoice, in case of the electronic invoicing system, that can be done online — so there are obvious time and management benefits to have the electronic invoicing system open for your company. Usually issuing the Special VAT invoices requires additional processing fee for most agencies to physically collect the invoices from the Bureau. In case of Special Chinese VAT Fapiao, the tax is paid at the time of the issue — and the tax amount is automatically deducted from the official company bank account.

TAX Rates for goods & services in China in 2023:

—for General Taxpayers in China

- 13% — All other taxable goods and services

- 9% — Retail; entertainment, hotel; restaurants; catering services; real estate and construction, telephony calls;

postal; transport and logistic - 6% — Financial services and insurance; telephony and internet data; IT; technology; consulting

—for Small Scale Taxpayers in China

- 1% — Special reduced TAX rat for small-scale taxpayers

—Additional Tax

*usually not applied to Foreign Companies

- 3% — Chinese National Education Tax

- 2% — Chinese Local Education Tax

- 7%, 5%, 1% — City Maintenance & Construction

- 3% — Construction Services

—Special Luxury Goods Tax in China

*Consumption tax applies to prescribed nonessential and luxury or resource-intensive goods

- 1%-56% — Including alcohol, luxury cosmetics, fuel oil, jewellery, motorcycles, motor vehicles, petrol, yachts, golf products, luxury watches, disposable wood chopsticks, tobacco, certain cell and coating products), and it mainly affects companies involved in producing or importing these goods. The tax is calculated based on the sales value of the goods, the sales volume or a combination of the two. The proportional consumption tax rate is from 1% to 56% on the sales revenue of the goods. Exports are exempt.

YouWin Consulting Chinese Invoice Service

At YouWin, we can help you to setup up paper invoicing system (requires special government issued invoice machine & maintenance fee) or electronic invoicing system (one-time opening fee for issuing both types of invoices). Our invoice issuing service benefits consist of:

- e‑invoice issuing (within the same working day)

- paper invoice issuing (within 3 working days)

- paper invoice delivery to client office directly (from our office to client office for additional delivery fee)

- verification of invoice and bank statement consistency (cross check the amounts and correct if needed)

If you have any questions about the invoicing system in China, please feel free to consult us. We help to optimise the issuing process and help you to maintain the proper operation of the invoicing services, which is both cost efficient and organized.

Corporate Online Banking in China operates according to different rules than in other places in the world.

When you set up your company official bank account, generally all of the transactions have to authorized via dedicated USB key. You will have 2 USB Devices Issued: one for creating transfer, and one for authorization.You will have also bank card issued as a foreign own business, but that card prevents any deduction operation, since its purpose it mostly to use as an authentication in the bank to print out statement — so there is no possibility for somebody to charge your account using your bank card.

Usually the device that “creates” a transfer, is with your accounting company, and the card as well — those two are used for proper accounting management. Its up to company owner to authorize any outgoing transactions from your corporate account. To summarize: the only way to move funds from and into the company account — you need to use the transfer as a method.

One more important information about banking system in China, is that if you receive the payment in foreign currency, there is actual fund release process within each bank, that requires providing additional information for the funds to be exchanged and released to your account (since it is in RMB). This requires regular visits to bank and scheduling appointments. We provide service that can make the process of release easier for you by visiting the bank branch and managing it on our side. As we stated: it is all about efficiency.

In YouWin, we found that for foreign based companies the issue is to actually make a transfer — since most of the transfer data, branch and additional information have to be done in Chinese. And if you have a lot of operation with your suppliers, that can be troublesome. That is why part of our primary service is to schedule, maintain and setup transfers for your company. At the end of each month, you need to do a monthly reconciliation and print transfer receipt & bank statements with the official bank branch stamp. That is required for properly closing the accounting period. For that the company bank card is used to access and verify that information.

Our Benefits for Online Banking Management:

- Payments (including the salary, cost & others) done in the same working day

- No wasting time in the bank to print out the monthly statements

- No issue with wrong transfer details in Chinese

- Easy operation & communication

- We help you to maintain stable relationship with your bank also by properly structurizing your transfers with descriptions, and informing you about any other activity or cost regarding your bank operation

- Easy process of release international transfer funds with additional fee

Human Resources (Employees) management in China requires few steps for the registration, maintenance and social insurance payments to function properly.

For each of your foreign or Chinese employee, there is a process to open special Government Insurance Account. The part of the management process is to properly edit/update & add information to the Chinese Company Social Insurance Account & Company Housing Fund Account. The system if fully in Chinese, so to better streamline the processes for your company, we can provide you with the serivce to fully manage the account and changes according to your company needs and growth.

The social insurance in China rates vary based on the city, but usually consists of 5 mandatory insurance schemes (pension fund, medical insurance, industrial injury insurance, unemployment insurance, and maternity insurance) + a housing fund (only applicable to Chinese employees).

Our Benefits for Managing your Human Resources:

- Easy process to open and manage company housing fund

- Efficient editing of the employee information in the company housing fund system

- Proper calculation of the specific insurance tax monthly (based on salary & regulations)

- Salary management (adjustment of the base salary, notification of the salary changes or any additional human resources costs based on Government regulations)

- Dedicated consultant for your HR management related tax & insurance accounts

There are 2 obligatory inspections that need to be done yearly to verify that the China based Company operates according to China Law & Regulations:

—Annual Company Operational Inspection

The Annual Industrial and Commercial Inspection is an annual report submitted to Commerce Administration Bureau within specified time limit (before end of June every year). That report will include the contributions made by the shareholders of the company, company assets status, inventory, etc. The annual report is obligatory to make sure, that the company operates according to Law & Regulations of the Chinese Commerce System, and company is fully responsible for the authenticity and legitimacy of the report. Moreover, the Commercial Department of China will conduct a random spot check on the contents of the annual report published by the company.

—Annual Tax Settlement & Inspection

After the end of the year, tax shall be levied on the taxable income of the whole year at the tax rate specified in the tax law. In order to ensure the timely and balanced collection of taxes, the company usually pay taxes in advance via monthly or quarterly tax period. The tax will be calculated in a yearly basis, and refunded for excess or supplements for insufficient tax payment. The timeline for the Yearly Tax Settlement submission is April every year.

YouWin Provide comprehensive Tax Export Refund Service to help companies to reduce tax burden and speed up growth. For the company to be able to cleaim the refund, we need to go through the following process:

- Import and export operation right [“Foreign Business Operator Filing Registration Form”

or Foreign Investment Approval Receipt] - Customs registration [Customs registration acceptance receipt]

- Registration of external management

- Bank registration [Account Opening License]

- Export tax refund (exemption) filing form [Notice of Tax-related Matters]

- The first on-site verification of export business

Export tax rebate calculation method

Small-scale taxpayers: Exemption - Export sales are exempt from VAT, and the input part is non-creditable and non-refundable.

Foreign trade enterprises: Exemption, refund - export sales are exempt from VAT, and special VAT invoices used for export and certified in the current period are subject to tax refund.

Production-oriented enterprises: Exemption, credit, refund - export sales are exempt from VAT, all input tax in the current period and the tax payable by the enterprise in the current period are deducted, and the inexhaustible part of the tax refund is deducted.

Tax Refund Calculation Example

The state will refund the value-added tax or consumption tax already paid by the enterprise in the domestic production and circulation of the goods declared and departed from the country

For example: a foreign trade enterprise acquires a total of 100 tons of product A, 10 yuan per ton, a total price and tax of 1130 yuan, (invoice price 1000, output 130), all export, price 1500 yuan. Product A: The refund tax rate is 9%.

Exemption: The export price of 1500 yuan of foreign trade enterprises is not subject to VAT

Tax refund: The state refunds the tax of foreign trade enterprises 100 × 10×9% = 90 yuan

(Levy and refund difference 1000 × (13%-9%) = 40 yuan Foreign trade enterprises count costs, foreign trade enterprises earn

1500−1000−40 yuan = 460 yuan)

*Focus: Details of information required for on-site verification

- Business license and company nameplate.

- Employee list, individual income tax withholding list, social security payment notice.

- If the actual place of business is self-purchased, provide a real estate certificate; If it is a lease, provide the lease contract, the lessor’s real estate certificate, and the rent invoice.

- Balance sheet for the latest period.

- The first export business declaration form, input invoice, export invoice.

- Purchase and sale contracts, payment vouchers, domestic transportation documents, freight forwarding vouchers (tally costs) corresponding to the first export business. Customs Clearance Fees. Transportation costs, etc.), bills of exchange, bills of lading, loading bills for export goods (payable to shipping company documents).

Other Services—

Other Services—

Other Services—

Other Services—

Protect your brand & products with trademark in over 100 countries with YouWin!

When your company is producing the unique products that needs protection from copying or reproducing by other, trademark is a solution for you to protect and quickly occupy the new markets around the world. YouWin Trademark Protection Service covers over 100 countries and regions around the world.

In standard process, the customer will select the country or region that he would like to register the trademark for, then we will provide the list of the documents and relevant information to fill in, we will submit the application and work with the relevant agency to review the application data. In case any problems are found, our representative will contact the customer for necessary adjustments and confirmation of changes.

The process of trademark registration can vary, but usually is quite lengthy, and we will continually follow the progress application and follow up to make sure, that everything is going in timely manner.

Required Documents:

- Trade name and scope of use

- Copy of business license or owner’s passport

Process Overview:

- Verification of the trademark registration data (*if the similar trademark was registered before)

- Document Verification & Submission

- Review from Trademark Office

- In China: Issue Temporary Certificate

- In China: Issue Original Certificate after Public Notice Period

- For China Official Trademark Registration, it usually takes 9–12 months to get the trademark registered.

Hong Kong is an international financial hub, a perfect link for the trade operations linking China and rest of the world.

We provide you with the service of the Hong Kong Company registration, to be able to improve your international trading possibilities. Hong Kong is an important international financial center, with a perfect banking system, free capital access and a flexible capital operation platform. The choice of the name and business scope of Hong Kong companies is very free. The company has few tax types and low tax rate, which is convenient for overseas investors to live and work in Hong Kong.

Documents:

- Company Name (CHINESE NAME and ENGLISH NAME) + Product name

- Identity Certificate (ID card two sides scan/Passport scan + hold your ID card/passport and take a photo)

- Address Proof (credit card statements office Rent contract Or Property ownership certificate Or Driving license)

- Business Plan (We will provide template)

- KYC CHART (We will provide the chart, and you just fill in it)

- Letter of Attorney for Registration (We will provide the chart, and you just fill in it)

Process:

- Provide information and sign documents;

- Submit registration application;

- Collect the license and seals;

- It takes 5–8 working days to complete the process

CBI United States Bank Account Opening

The overseas account we opened is mainly CBI bank account. CBI Bank is a licensed commercial bank in the United States, which supports the provision of one-stop cross-border financial services in euros, dollars, offshore and individuals, including offshore RMB and other international mainstream currencies.

Documents:

- All passport pages scanning;

- Company business licence scan;

- Personal bank statement of recent 6 months (with address);

- Fill the information form (we provide)

Process

- Provide information and sign documents;

- Submit documents;

- Video interview with Bank Representative;

- Get the bank account number and bank keys;

- It will take 5–10 working days.

We provide the service of the translation & certification of your documents.

In company operation & HR processes, we often need to have documents and certificates verified and notarized. Those documents are often required as a part of the application process: to receive the proper Work Permit Category, to register a company, to verify the ownership, etc.

We provide overseas academic certification services. In addition, we also provide notarization services for your education in China and your criminal record in China. Relevant materials can be translated into different form and certified / authorized according to your needs and application process.

Process

- Provide required documents;

- Pay the certification fee;

- Get the result of certification.